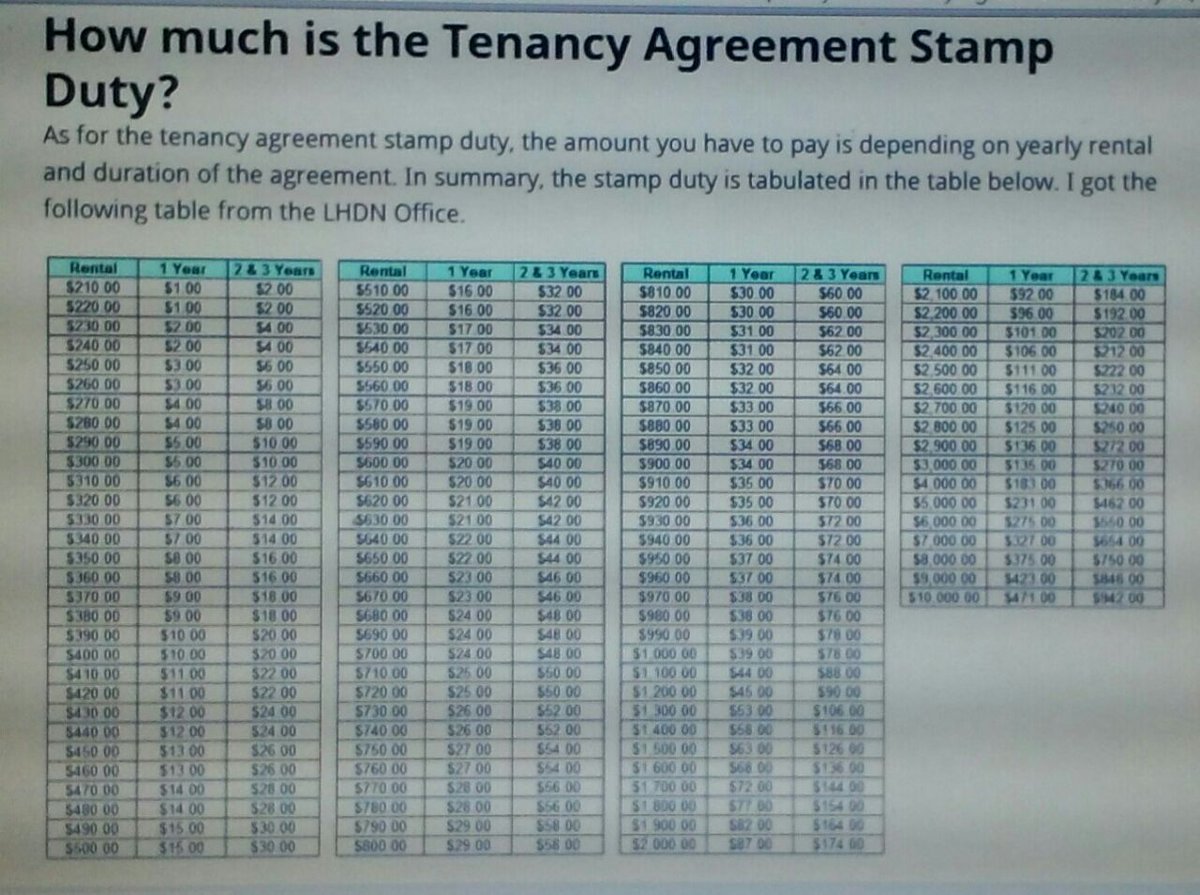

Lhdn Tenancy Agreement Stamp Duty Table

Stamp duty calculation malaysia 2019 and stamp duty malaysia exemption stamp duty.

Lhdn tenancy agreement stamp duty table. It s sort of like paying income tax for income but now you re paying tax for an agreement. Lhdn aka the inland revenue board of malaysia. In summary the stamp duty is tabulated in the table below. Feel free to use our calculators below.

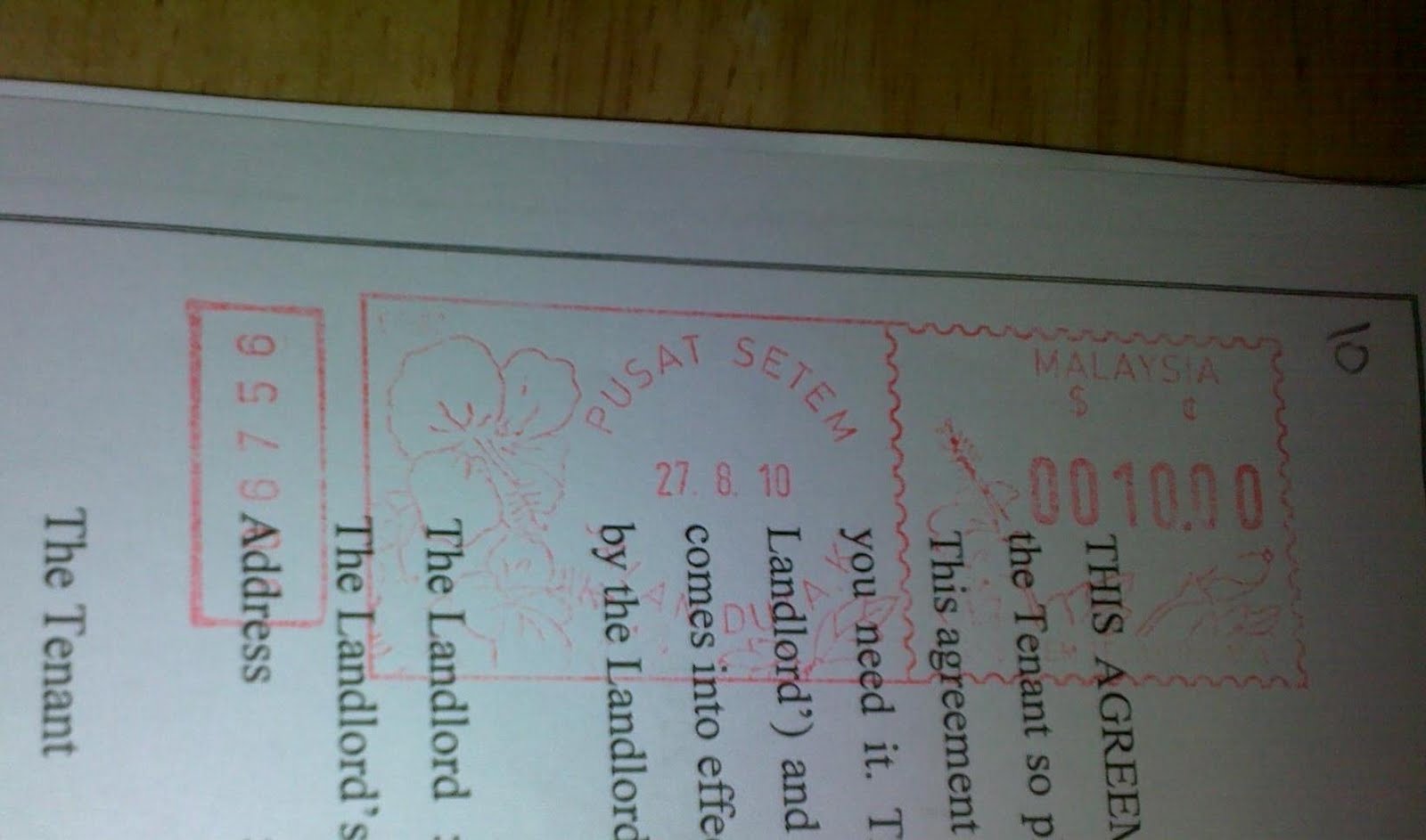

How to stamp my tenancy agreement. Tenancy period 3 years payable stamp duty rm30 000 rm250 x rm4 120 x rm4 rm480 figures will be rounded up step 4. This would cover things such as tenancy agreements and land titles and even insurance policies. Loan agreement stamp duty.

Go to your nearest lembaga hasil dalam negeri office which is the same place where we submit our income tax. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949. I got the following table from the lhdn office. Enter the monthly rental duration number of additional copies to be stamped.

Balance to pay 750 00. Above table listed are for the main copy of tenancy agreement. The stamp duty for sale and purchase agreements and loan agreements are determined by the stamp act 1949 and finance act 2018 the latest stamp duty scale will apply to loan agreements dated 1 january 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 july or later. For second copy of tenancy agreement the stamping cost is rm10.

So far i have been only 3 lhdn offices namely. Total cost involved for tenancy period of 1 year diy tenancy agreement stamp duty stamping for 2nd copy rm120 rm10 rm130. To use this calculator. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement.

Prepared two copies of tenancy agreement and duly signed by both tenant and landlord. Stamp duty is a tax duty that s imposed on documents that have a legal commercial and financial effect. We have new articles that you might interested to read.